We provide independent foreign exchange risk management

consultancy services supporting international traders

to manage their currency positions better

Note: We also have a division that serves high net-worth individuals

Is your business exporting or importing?

How do you handle currency movements?

Do you easily minimise adverse impacts and manage risks?

We answer the BIG questions, manage uncertainty, eliminate guesswork and provide organisations with peace of mind in the currency market.

Banks and brokers ignore currency buyers’ real requirements.

SMEs which lack the resources to employ FX specialists run uncontrolled management risks, detrimental to their bottom line.

Let us Help

First, get comfortable with us.

We will set up an initial consultation for you with one of our senior consultants, who has over 30 years of experience assisting SMEs; Public Listed Corporations and everything in between.

Who does this help, and what do they say?

- Owners

- I have peace of mind knowing that the right strategy is implemented to accommodate whatever changes occur in trade flows.

- The Board

- Our board need this degree of global consolidation and transparency to be able to manage exposures effectively.

- Having both forex and accounting clarity is very helpful.

- Financial Directors

- The reports are meaningful and easy to read and can be compiled in the way that’s needed.

- I now understand the tension and impact of forex accounting on commercial decision making.

- Our Year-End is so much easier, the information and reconciliations are all prepared and balance.

- Financial Controllers

- I can now access in one place, what we had in three places.

- Good riddance to our out-of-date spreadsheets.

- My team no longer get involved in the administration follow-up that use to waste so much time! I’m not sure if this is because less problems are happening or whether problems are just dealt with so seamlessly.

- Purchasing and Sales

- We like the benchmarking information as it shows how the business has been performing which provides management information to support supplier and customer negotiations.

- High Net Worth Individuals

- Great for once-off (singular) trades or multiple high-value trades.

Discussion topics covered will include how we will help you to:

- Embrace your foreign currency management system

- Focus on your currency requirements

- Take advantage of favourable market movements whilst minimising risk

- Manage your business risks in response to currency movements

- Handle rate negotiation with carefully selected providers

- Ensure currency activities are accurately reported in the financials

- Ensure the costing of products and services is appropriate

- Account for correct profits and cash-flows

- Create a forex strategy that is aligned to your corporate objectives

- Free yourself to run your business without worrying about currency impacts

Some IMPORTANT questions we might ask include:

- Do you have a qualified Treasury Manager, or does your finance department handle this?

- What systems are you using to manage your Forex?

- Have you ever taken a Forex loss or profit that you do not understand?

- Is the costing of your products efficiently aligned to your Forex portfolio?

- Does the Executive Committee/Management receive quality management information about Forex?

- Is your Forex correctly accounted for at Year-End in terms of GAAP or IFRS (International Financial Reporting Standards)?

- Are you able to determine P&L per international invoice?

- Can you determine the costs to the business from changes in shipping and supply of goods, including but not limited to under-shipments, over-shipments, part-shipments, late-shipments, early-shipments, demurrage, etc.?

We can also seamlessly integrate with you to ensure exposures are known ahead of time!

You authorise transfers of funds. They are never routed through our bank accounts.

We do not speculate on currency movements. We only manage currency exposures that are non-speculative and are required to hedge commercial risk, in line with the customer’s business strategy.

Our revenues are NOT dependent on transaction activity but a small, pre-agreed retainer.

This independence removes the risk of concluding transactions which may not be in the best interests of the customer.

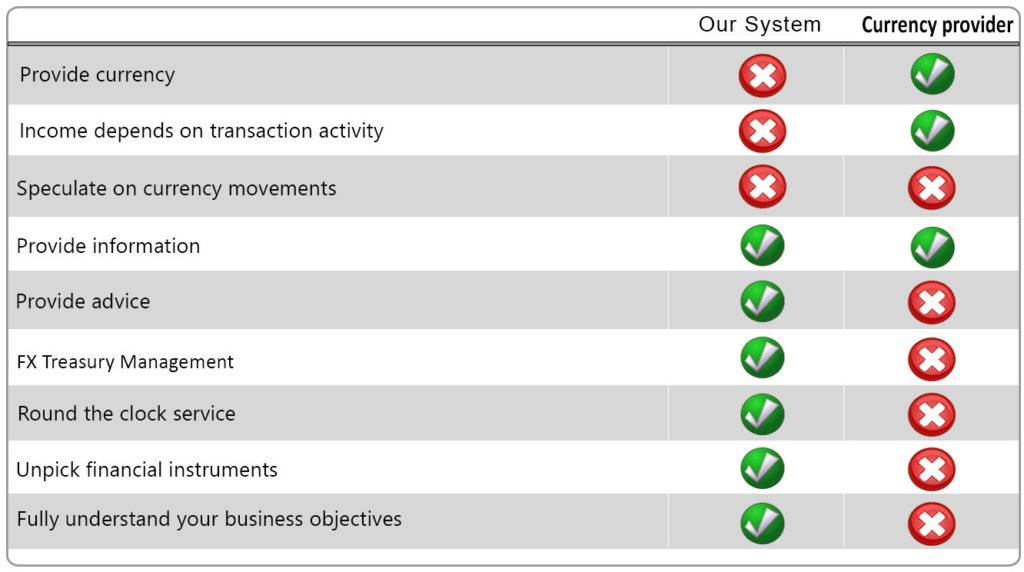

This Chart summarises our first conversation and shows how we are different from Currency Providers and FX Brokers

After the call, progression to a Formal Evaluation may result where we will:

- Conduct a full review of your company to understand where and when your risks and exposures truly arise

- Analyse your current hedging program for applicability and effectiveness (you provide your forecasts, purchase orders and invoices)

- Work together to determine a specific risk profile and build your forex strategy Stress tests are used to ensure your risk appetite correctly aligns to your hedging strategy

- Agree on the major drivers and cycles of your business so that we can determine what currencies and amounts need to be hedged and for how long

- Introduce our FRM software which will determine the relationship between your exposures and your hedging instruments (our Forex Risk Management Software manages and records both sides of your portfolio) Our software replaces risky worksheets (usually Excel) and administrative strain by being fully transparent, giving clarity on all transactions, correctly handling accounting and costing, and valuable “what-if” analyses

- Provide complete transparency to allow your hedging strategies to be monitored, adjusted and reported accurately, whilst removing administrative burdens The complete visibility provided by our FRM software allows your hedging position to be continuously monitored and adjusted.

- Negotiate rates and fees on your behalf with many different currency providers with whom we’ve built a relationship and now know their specialisations and pricing models (these services are usually delivered locally with local banks and currency providers)

- Dissect any complex instruments offered to assess their suitability

- Provide a fresh pair of eyes so that your board gains assurances and understanding on forex risks, opportunities and processes

- Oversee your funds-flow, contract management, maturities and determine true costs and income

A. Your funds do not route through our bank accounts.

B. You authorise the transfer of funds to and from third parties at your sole discretion based on solid factors and indicators.

C. We do not provide currency.

Our clients typically see an increase to their bottom line over 3% of the FX turnover

Going forward, we will determine the best working relationship and operational solution most effective for your needs which could involve once-off currency audits, training and project management, or it could be a fully-fledged outsourced forex service.

You authorize transfers of funds. They do not route through our bank accounts.

To summarise, we address your forex needs with regard to risk assessment, strategy definition, product structures, hedging time windows, use of premiums and discounts, spot rate management, deal negotiation, currency movement accounting, product costing and all detailed reporting required for the various departments and individuals in the business.

The power is in knowing what is happening within the business and therefore, how to interface correctly with the market; this being feasible using the powerful software that tracks the business information and the transaction information.

The service handles all the implications of forex on the business, accounting actions and entries, cash flow management, daily portfolio review, payment and receipt decisions, negotiating the rates with providers, full detailed reporting on all forex and determination of the exact cost or revenue to the business of every foreign invoice.

We are accepting customers in the UK, SA, Africa, Europe and other Commonwealth markets, particularly where there are natural links to the United Kingdom or South Africa, but we welcome enquiries from other jurisdictions.

Our services are primarily aimed at medium to large corporates with monthly export/import figures exceeding £20,000 and growing.

We do also have an office that caters specifically to high net worth individuals looking to complete singular or multiple currency movements.

Note: Due to international regulations, we are obliged to do the standard due diligence checks on companies and individuals. We make this process as painless and seamless as possible

Case Studies

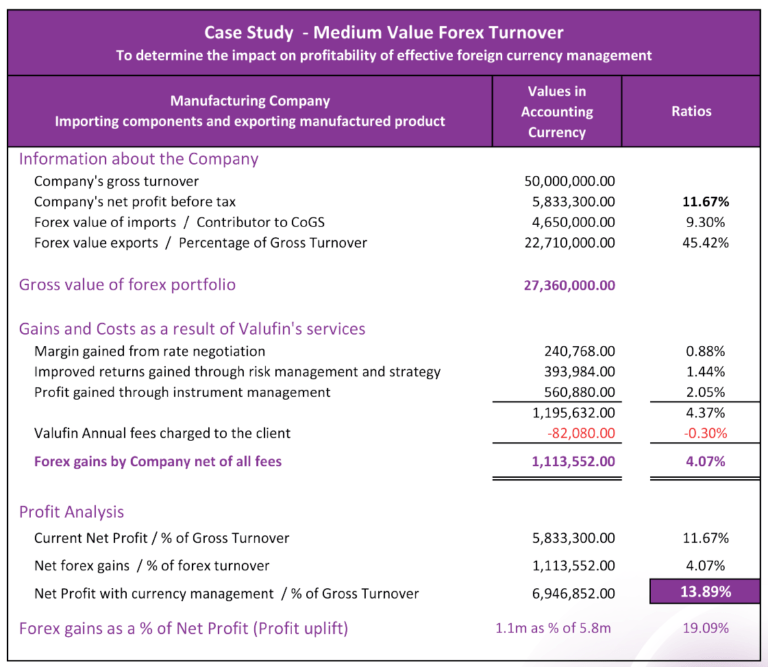

Example One

A medium sized business where just over 45% of the annual turnover of £50m is forex related and the company is realising a NPBT of 11.67%. Forex management delivers a direct profit improvement of 4.07% which equates to an improvement in the bottom line of 19.09%.

Notes:

Company is a manufacturing business that imports approximately 10% of turnover in components from China and manufacturers finished products sold locally and in the USA, Europe and Africa, foreign sales contributing about 45% of gross turnover.

There are currency opportunities to net off common USD values, but due to timing differences and market opportunities it is often best to manage to base currency.

Given the mix of currencies it affords the opportunity to consider all currencies to the USD and then independently, the USD versus the home currency.

The finance department has full visibility of transactions and has 24/7 access to the online currency portal FRM (Forex Risk Manager) to plan payments, update exposures, check receipts, review currency deals, determine

revaluations and reconcile balances in the Balance Sheet and Income Statement.

• We negotiate the rates, choose the right provider and product to maximise benefits.

• We interrogate the portfolio on a daily basis to assess opportunities, carry out transactions and review

open positions.

• We proactively respond to market movements relative to the portfolio of import and export requirements

and buys for imports and sells for exports when advantageous.

• Considerations include currency rates, interest rates, expected movements, internal costing rates, price

sensitivity, relative size, credit lines and instruments.

• We as a management team member help with the export pricing strategy, risk appetite definition, aligning

of remuneration plans and reports currency activity to the Board.

We work with the finance department to ensure that the accounting entries reflect the correct conversion rates, the profit and loss is accurately reflected per transaction and supports the preparation of the relevant

accounting reports for finance, sales and the Board.

The company has improved its profit return by £1 113 552 from £5 833 300 to £6 946 852, which has increased the net profit percentage from 11.67% to 13.89%, an improvement in the net profit of 19.09%

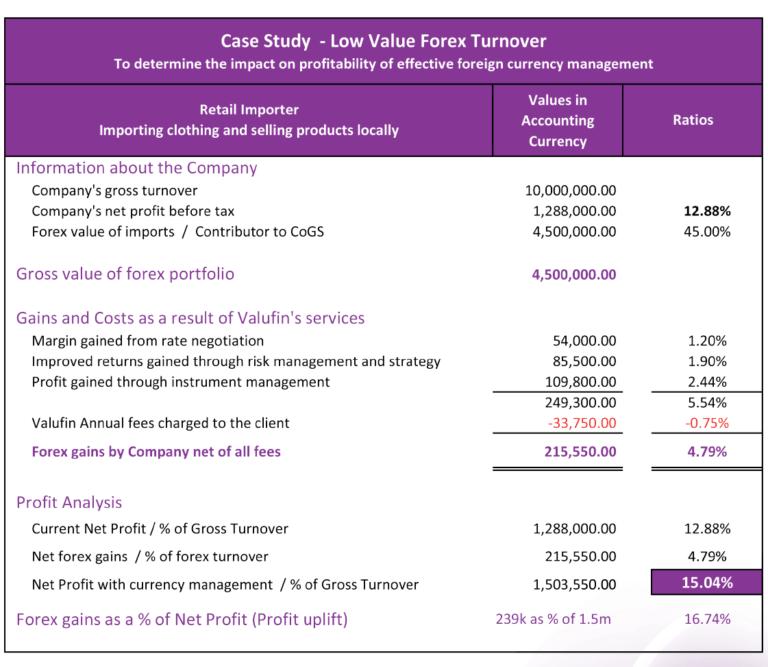

Example Two

A smaller sized business where about 50% of the annual turnover is forex related and the company is realising a NPBT of 12.88%. Forex management delivered a gross return of 4.79% after management fees which equated to a profit uplift of 16.74%.

Notes:

Company is a clothing business that imports approximately 45% of turnover in clothing from China, Africa and

Eastern Europe and sells the imported products locally.

Given the mix of currencies it affords the opportunity to consider all currencies to the USD and then

independently, the USD versus the home currency.

The finance department has full visibility of transactions and has 24/7 access to the online currency portal FRM (Forex Risk Manager) to plan payments, update exposures, review currency deals, determine revaluations and

reconcile balances in the Balance Sheet and Income Statement.

• We negotiate the rates, choose the right provider and product to maximise benefits.

• We interrogate the portfolio on a daily basis to assess opportunities, carry out transactions and review

open positions.

• We proactively respond to market movements relative to the portfolio of import requirements and buy currency when advantageous.

• Considerations include currency rates, interest rates, expected movements, internal costing rates, price sensitivity, relative size, credit lines and instruments.

• We as a management team member help with the import pricing strategy, risk appetite definition, aligning of remuneration plans and reports currency activity to the Board.

We work with the finance department to ensure that the accounting entries reflect the correct conversion rates, the profit and loss is accurately reflected per transaction and supports the preparation of the relevant accounting reports for finance, sales and the Board.

The company has improved its profit return by £215 550 from £1 288 000 to £1 503 550, which has increased the net profit percentage from 12.88% to 15.04%, an improvement in the net profit of 16.74%

FOREX Courses

Interested in doing a beginner, intermediate or advanced Forex Treasury Management Course?

Register your interest here:

Beginner (never worked in a Forex Treasury Department before, but interested)

Intermediate (some daily exposure to the Treasury Department activities)

Advanced (daily involvement with the management of the Treasury Department)